UNICAP CRYPTO EXCHANGE

Cryptocurrency (crypto currency) is indeed the number 1 buzzwords (topic of discussion) in the world today, especially Bitcoin. Almost all cryptocurrencies have seen a sharp increase this year. Three of the most popular are: Bitcoin increased by about 369%, Ethereum increased by about 2,500%, and Ripple increased by almost 4,000%. Currently, the cryptocurrency market has become one of the most famous markets for its fluctuating and voting crowds, making it the best place to invest.

Crypto exchange-traded funds (CETF) are a type of exchange-traded funds and products, that is, they are traded on a crypto exchange. CETF is similar in many ways to mutual funds, except that CETF is bought and sold 24 hours a day on a crypto exchange. CETF holds assets such as cryptocurrencies, tokens, coins, and generally operates with an arbitrage mechanism designed to keep them trading close to their net asset value, although irregularities can sometimes occur.

CETF divides its ownership into tokens held by token holders. The token holder indirectly owns the fund asset. Token holders are entitled to a share of the profits, and they are entitled to the residual value if the funds are liquidated.

CETF may be attractive as an investment because of its low costs, asset aggregation and marketability. Source: https://en.wikipedia.org/wiki/Exchange-traded_fund;

Reliability

This project was created by the FINEXPO company that has existed since 2002. The main project of FINEXPO is the luxury trade fair and exhibition which is held annually around the world. The event was attended by more than 200,000 visitors and 3,000 companies worldwide. The company is also the owner of IQ.cash and Master.Money. The geography of the show is extensive and includes the following countries: Thailand, Malaysia, Indonesia, Singapore, Vietnam, India, Egypt, Cyprus, China, Philippines, Kazakhstan, Russia, Ukraine, Slovakia, Latvia, etc.

Market Issues

On an income-driven mission, they began to take aim at quickly making DeFI a new organization. Regardless, here they see that so far most DeFi tokens do not have a genuine business but want how productive the venture is, so that they can without augmentation a very extraordinary stretch and will most likely reduce their costs. Market differentiation can appear at 1-100-1 USD, so creators get paid for it.

All those adventures did not lead to any real gain for the monetary authority, UNICAP. Financial Funds with DeFi natural framework to get additional profit from your crypto assets that are inactive. Monetary authorities can tackle this problem, start growing profits and get basically consistent compensation by making crypto resources or total effort.

Crypto exchange (CETF) resources are a kind of resource and swapd exchange, for example they are exchanged on crypto exchanges. CETF is similar from various perspectives to normal resources, on the other hand, CETF is literally bought and sold for 24 hours on crypto exchanges. CETF holds assets, for example, cryptographic money, tokens, coins, and generally works with a portion of the swap that is planned to keep trading close to its net asset value, although irregularities can occur occasionally.

CETF limits the obligations related to tokens held by token holders. The emblem holder with suggestions owns a resource asset. Token holders are equipped for the profit segment, and they will be equipped for extra value if the resource is liquidated. CETF might be used as a hypothesis because of its low cost, aggregate assets, and selling power.

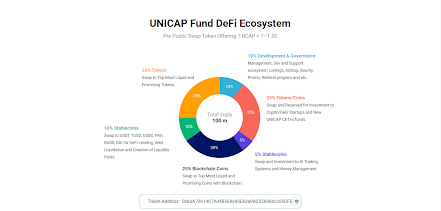

UNICAP Fund Supply Allocation:

- 5% Stablecoins. AI Investment and Money Management Trading System: USDT, TUSD, USDC, PAX, BUSD, DAI. Allocation of funds in the form of stable coins for trading in artificial intelligence systems. Short-term trading - day trading. Trade futures, options and synthetic instruments.

- 25% Reserved for Investments into Crypto / DeFi Startups and new CETF UNICAP funds. : Promising initial token / coin exchange to UCAP tokens for project development, partnership listing, and capitalization doubling for further profit and fund capitalization increases. It is planned that the UCAP token owner will choose to invest in the startup.

- 10% Stablecoins. : USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi loans, debt liquidation, and liquidity pool creation.

- 25% Blockchain Coins. : Top most liquid and promising coins with blockchain. Profile management. The rotation of funds for liquidity and capital increases by converting inactive or decreasing to be more promising in terms of fund policy.

- 25% Token (Any Platform). : The most liquid and most promising token. Profile management. The rotation of funds for liquidity and capital increases by converting inactive or decreasing to be more promising in terms of fund policy.

UNICAP ECOSYSTEM

Token Specifications and Sales Allocation

- Token Ticker: UCAP

- Token Type: ERC-20

- Blockchain: Ethereum

- Legal Classification: Utility Token

- Total Supply (Number of Tokens): 100,000,000

- Private Swaps: 250,000 UCAP (0.20%) at a price of USD 0.8 per UCAP

- Pre Public Swap Level 1: 300,000 UCAP (0.30%) at a price of USD 0.8 - 1 per UCAP

Roadmap

Q3 2020: Idea Generation. CETF & DeFi product research. Brainstorming. Team formation, UNICAP financial creation

Q4 2020: Site development. Investor Personal Account Opening (14 languages), Smart contract deployment and UCAP token mining. Public token swap offering. Global Unicap community development. Promo / Airdrop / Bounty.

Q1 2021: DeFi Bank product design and prototype. Exchange tokens. Register tokens on KuCoin / Bittrex / FTX / Exmo / Lbank. AirDrop for the DeFi community. Development and Launching of New Funds. The first global community survey.

Q2 2021: Launch of UNICAP DeFi Bank v1, Development and Launch of New Fund. Exchange tokens. Register OKEX, HUOBI, BINACE. Acceptance of funding proposals for Crypto / DeFi startups.

Q3 2021: Launch of UNICAP DeFi Bank v2 (new protocol). Development and Launching of New Funds. Including New Funds.

Q4 2021: UNICAP New Startup Launch. Listed Startup in OKEX / HUOBI / BINANCE.

CONCLUSION

The DeFI startup is growing rapidly. However, most DeFi tokens have no real business but only have expectations about the success of the project, so they can be easily scaled up and can be easily scaled back while the Process by UNICAP keeps its users safe, profitable and transparent. The above is personal information that I provide not investment advice. For more information, you can visit the link below ..

DETAIL INFORMATION:

Website: https://ucap.finance/

UNICAP_WP: https://ucap.finance/docs/ucap_wp_v1.pdf

Telegram: https://t.me/unicap_finance

Facebook: https://facebook.com/tradersfair

Twitter: https://twitter.com/unicapfinance

Linkedin: https://www.linkedin.com/showcase/unicapfinance/

Discord: https://discord.gg/BJBA4Yb

ANN: https://bitcointalk.org/index.php?topic=5278941.msg55283491

Author: Homio

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=2865336

Komentar

Posting Komentar